12 Characteristics of a Good Business Plan: What Makes It Effective and Investor-Ready?

April 04, 2025 · 6 min read

A good business plan is very important for success. It helps business owners stay focused and organized. When a business plan is clear and strong, it becomes easier to get support from other stakeholders, like investors. Investors want to see if a business plan is effective and investor-ready. This means the business plan should explain the business goals, how to reach them, and how money will be used.

A strong business planning framework shows that the owner is serious and ready to succeed. Planning helps people avoid mistakes and make better choices. It also gives a clear path to follow as the business grows. That is why understanding the characteristics of a good business plan is the first and most important step. It builds the base, or root, for all other business ideas to grow.

Why the Quality of Your Business Plan Matters

The quality of your business plan matters because it affects every part of your business. A strong business plan helps you get funding.Investors and lenders require a solid business plan to assess the viability and the potential of your business. If the business plan is weak, you might face failed funding rounds and miss your chance to grow.

It also helps with daily operations by giving clear goals and outlining the steps to achieve them. Without it, goals can become unclear, and teams may get confused. Over time, poor planning can lead to bad decisions of time management, wasted money and resources not being sufficiently and efficiently allocated. Many people feel stressed when things do not go as planned, and often it starts with a weak business plan.

A strong, clear business plan makes you feel more confident as you are able to anticipate potential risks and take action in advance and also keep your business on track as you continuously review and update your business plan. It shows both emotional strength and smart thinking. That is why having a good business plan is not just helpful, it is necessary for success.

12 Key Characteristics of a Good Business Plan

This section is the heart of understanding what makes a business plan strong. A good business plan is more than just ideas written on paper. It needs to be clear, realistic, and easy to follow. Investors and business owners use these key points to see if a business plan is effective and investor-ready. These characteristics help guide actions, make smart choices, and avoid problems.

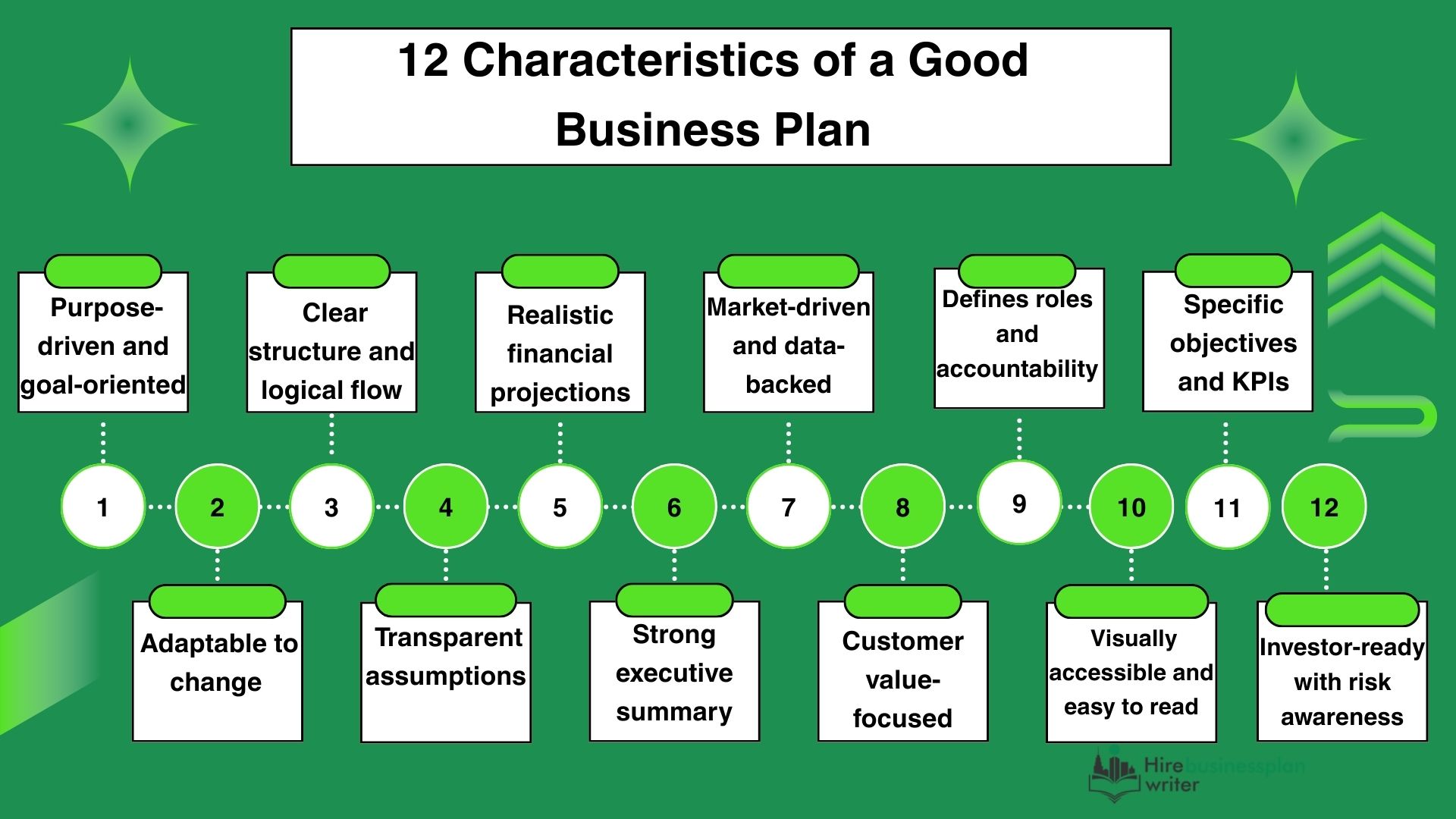

A well formulated business plan also builds trust with partners, teams, and supporters. It shows that the business is serious, well planned, and ready for growth. Each part of the business plan should work together like pieces of a puzzle. When all these pieces are in place, the business plan becomes a powerful tool for success. The following are the 12 characteristics of a good business plan also well displayed in the image below;

1. Purpose-driven and goal-oriented

Purpose driven and goal oriented should be the central point of a good business plan. It should start with a clear reason for why the business exists. When the business plan matches the mission of the business, it becomes easier to make smart choices. For example, if a company wants to help people eat healthy, every part of the business plan should support that mission. Setting clear goals also makes the business plan stronger.

One way to do this is by using SMART goals, goals that are Specific, Measurable, Achievable, Relevant, and Time-bound. These types of goals help business owners stay focused and track progress. When goals are clear, it is easier to explain the business plan to investors or team members. A purpose driven business plan gives direction, while goal setting keeps the business moving forward. This mix of purpose and goals is a key part of building an effective business plan.

2. Clear structure and logical flow

Another important characteristic of a good business plan is a clear structure and logical flow. The business plan should be easy to read and follow. Each section should be in the right order, starting with the most important parts like the business idea and goals. Headings and subheadings help the reader find what they are looking for quickly.

The writing should be simple and straight to the point. Think of it like a website, if the design is messy, users get confused. But if the layout is clean, people enjoy using it. A business plan works the same way. When it looks neat and makes sense, it is easier for investors and others to understand. This helps build trust and keeps the reader interested from the start to the end.

3. Realistic financial projections

A well organized business plan must have realistic financial projections. The money numbers in the business plan should make sense and be based on facts. Important documents like the cash flow statement, profit and loss (P&L), and balance sheet should be included. These show how money comes in, how it is spent, and what the business owns and owes.

It is also important to explain the estimates, or assumptions, behind the numbers. For example, if you expect to sell 1,000 items a month, you should say why. A small margin of error is okay, because no one can predict the future exactly. But the numbers should still be close to real life. Investors want to see that you understand your business and your money. Realistic financial planning helps build trust and makes your plan investor-ready.

4. Market-driven and data-backed

A good business plan should be market-driven and data-backed. This means it should be based on real research, not just guesses. Business owners should study the market to understand what people want and how much they are willing to pay. They should also look at their competitors to see what is working and what is not. This is called competitor analysis.

Using facts helps make evidence-based and data-informed decisions. For example, if the research shows that people like fast delivery, the business plan should include that. Real numbers and real trends make the business plan stronger and more believable. Investors want to see proof that the business idea can work in the real world. A business plan that uses market research and data builds confidence and shows serious thinking.

5. Defines roles and accountability

Roles and accountability should be well defined. A business plan should clearly show who is doing what in the business. An organization chart is helpful for showing the structure of the team. It lists the names, titles, and main jobs of each person. Everyone should know their tasks and who they report to. This helps avoid confusion and makes sure work gets done on time.

The business plan should also explain the founder’s role and what other team members are responsible for. When roles are clear, people can focus better and work as a team. Investors like to see that the business has strong leadership and teamwork. A clear business plan builds faith and keeps everyone on the same page.

6. Specific objectives and KPIs

Specific objectives and KPIs are key elements in a well organized business plan. Objectives are the clear goals a business wants to achieve. KPIs, or Key Performance Indicators, are numbers used to measure how well the business is doing. Every business strategy should connect to a goal that can be measured. For example, if the goal is to grow sales, a KPI might be “monthly sales numbers.” Goal tracking tools like OKRs (Objectives and Key Results) or dashboards can help keep track of progress.

These tools show if the business is moving in the right direction or needs to change something. When goals are clear and tracked with real data, the business plan becomes stronger. It also helps teams stay focused and motivated. Investors gain more confidence in the business plan that uses numbers to show results and success.

7. Adaptable to change

A strong business plan should be adaptable to change. This means the business plan can adjust when things do not go as expected. Sometimes, markets shift or customer needs change, so the business plan should include backup ideas called contingency plans. These help the business stay on track even during hard times.

A well structured business plan also includes pivot strategies that is, ways to change direction if the first idea does not work. This is part of dynamic planning, where the business plan grows and improves over time. Tools like the Lean Canvas model help business owners make fast updates when needed. Being flexible shows that the business is ready for real-world challenges. It also helps teams stay strong when faced with new problems. Investors like plans that can adjust and still succeed.

8. Transparent assumptions

Transparent assumptions are a crucial part of a good business plan. It means the estimates used in the business plan should be clear and make sense. For example, if the business plan says the business will sell 500 items a month, it should explain why that number was chosen. These projections should be based on logic, research, or past results. It helps to label each assumption with a confidence level, that is, like high, medium, or low. This shows how sure the owner is about each guess.

Some parts of the business plan may also have risk factors, which are things that could go wrong. Being open about these helps investors see that the business plan is honest and well thought out. It also helps the team prepare for different outcomes. A business plan with transparent assumptions clears most doubts and shows smart planning.

9. Strong executive summary

A strong executive summary is of great importance in a business plan. This is a short part at the beginning that gives a quick look at the whole business plan. It should be clear, brief, and easy to understand. The goal is to quickly show why the business idea matters. It should explain the problem the business is solving and how it brings value to customers.

The summary should also mention the financial outlook, how the business will make money and grow. This part is very important because it is the first thing investors will read. If it is strong, they will want to keep reading the full business plan. A good executive summary saves time and grabs attention. It helps show that the business is serious, focused, and investor-ready.

10. Customer value-focused

A successful business plan should be customer value-focused. This means the business plan should clearly show how the business helps customers. One way to do this is by sharing the UVP, or Unique Value Proposition. The UVP explains what makes the business special and why people should choose it.

The business plan should also talk about customer pain points, problems the customers face and how the business will solve them. Showing real outcomes, like saving time or improving health, makes the business plan stronger. It helps to use customer journey mapping, which follows the steps a customer takes from learning about the business to buying something. This shows that the business understands its customers well.

When a business plan focuses on customer needs, it feels more real and helpful. Investors like to see that the business puts people first. A customer focused business plan creates sureness and shows long term value.

11. Visually accessible and easy to read

A business plan should be visually accessible and easy to read. This means it should look clean and be simple to understand. Using visuals like charts, tables, and infographics helps explain ideas faster. These tools show numbers, comparisons, and progress in a clear way.

The document should also be well organized, with short sections and clear headings. This makes it easy for readers to scan and find what they need quickly. Bullet points and bold text can also help highlight key points. When a business plan looks neat, people are more likely to read and trust it. Investors do not have time to read long, messy pages. A simple and visual business plan keeps their attention and shares the message clearly.

12. Investor-ready with risk awareness

A good business plan should be investor-ready with risk awareness. This means it should show both big ideas and real-world thinking. Investors want to see that the business has a strong vision but also understands possible problems. The business plan should include a SWOT analysis, which shows the Strengths, Weaknesses, Opportunities, and Threats of the business.

It should also talk about risk factors which are the things that might slow down or hurt the business. This can include money issues, market changes, or strong competitors. By sharing these roadblocks early, the business plan shows honesty and smart planning. Investors like to see that the owner is ready for challenges, not just hoping everything goes right. A business plan with vision and risk awareness builds confidence and shows the business is prepared to grow in a smart way.

Characteristics Investors Look for in a Business Plan

This segment is for founders who want to get investment for their business. Investors look for certain key things in a business plan before they decide to give money. First, they want to see strategic scalability, this means the business can grow over time without big problems. They also look for clarity, where everything is explained in a simple and smart way. If the business plan is confusing, they may not trust it.

Another important part is market opportunity. Investors want to know there is real demand for the product or service. They ask, “Is there space in the market for this idea to succeed?” A well defined business plan should answer that question clearly. It should also show that the founder has done research and understands the market well. When these points are included, the business plan becomes more investor-ready and trusted.

Who Writes a Business Plan that is Good for Investors?

A business plan that is good for investors should be written by someone who understands both business and planning. Many times, business owners write their own business plans, but it helps to get support. Business plan writing companies and consultants know how to explain ideas in a clear and professional way. They also know what investors want to see.

Some people also work with business modelers who help plan how the business will run and grow. These experts use facts, research, and proven methods to build strong plans. Having another person review the business plan can also help catch mistakes or weak points. A second opinion makes the business plan even better. When the business plan is well written, it has a better chance of getting investment. That is why working with the right people is a smart choice.